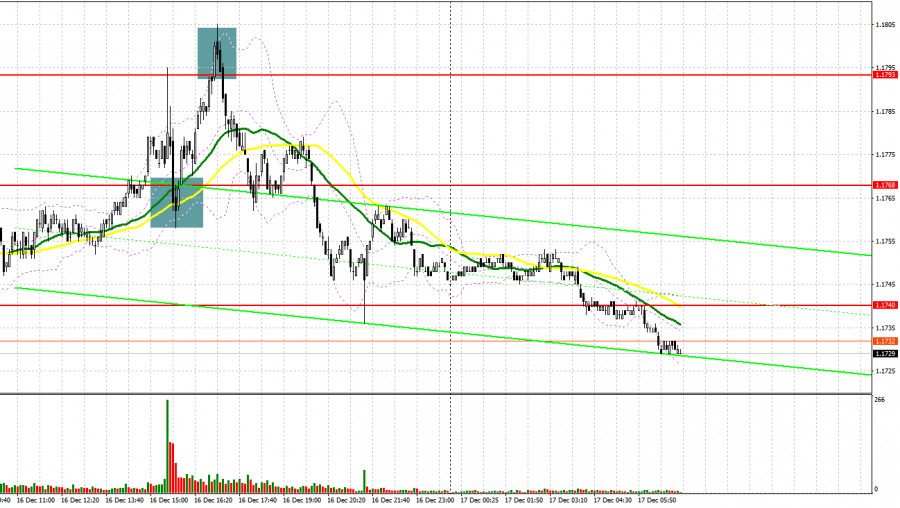

Yesterday, several entry points into the market were formed. Let's take a look at the 5-minute chart and analyze what happened. In my morning forecast, I emphasized the level of 1.1768 and planned to make entry decisions based on it. An increase occurred, but the 1.1768 test never happened, leaving me without trades. In the second half of the day, a false breakout around 1.1768 prompted a purchase of euros, driving the pair up by more than 40 pips. Active selling in the area of 1.1793 allowed for short positions to be entered closer to the middle of the U.S. session, resulting in a further decline of the pair by another 30 pips.

To open long positions for EUR/USD, it is required:

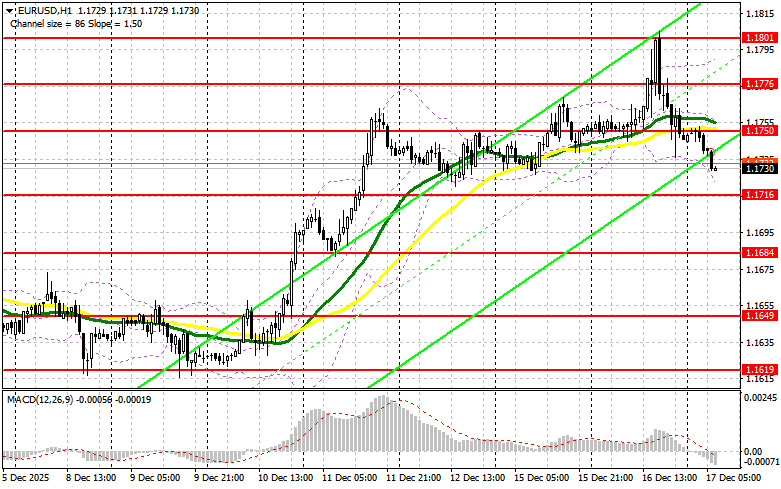

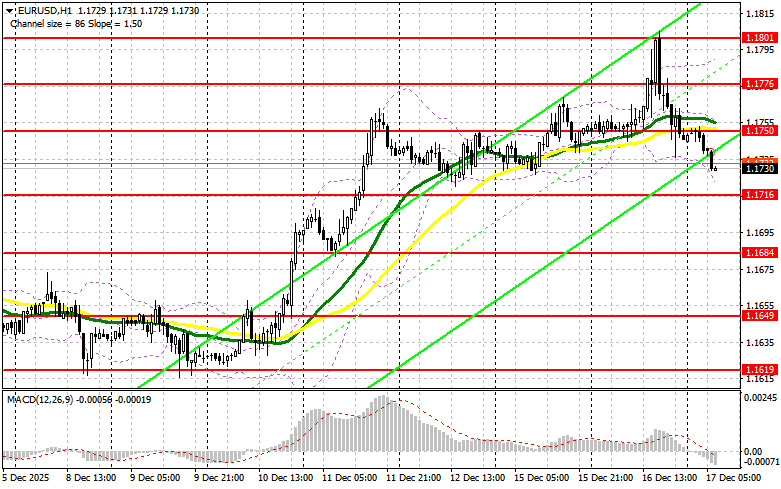

The dollar sharply declined after news that the U.S. unemployment rate reached 4.6% — a figure not seen since the peak of the COVID-19 pandemic. Data on employment also indicated that the labor market situation continues to worsen. However, today, euro buyers will face new challenges. In the first half of the day, data from the IFO about Germany's business climate index, current situation assessments, and economic expectations are expected. Immediately after this, the Eurozone's November inflation report will be released. It is expected that the inflation rate will remain unchanged. In the event of weak indicators and a decline in the euro, I expect to see the first signs of buyers around the 1.1716 support level. Only after forming a false breakout can one obtain an entry point for long positions, aiming to recover to the 1.1750 region. A breakthrough and a retest of this range will serve as confirmation for further buying the euro in anticipation of a larger surge toward 1.1776. The farthest target will be the high of 1.1801, where I will take profit. Testing this level will strengthen the bullish market for the euro. In the event of a decline in EUR/USD and a lack of activity around 1.1716, pressure on the pair will increase, potentially leading to a reversal of the recent bullish market. In that case, bears will attempt to reach the next interesting level of 1.1684. Only the formation of a false breakout there will be a suitable condition for buying the euro. Long positions will be opened immediately on a rebound from 1.1649, targeting an upward correction of 30-35 pips intraday.

To open short positions for EUR/USD, it is required:

Euro sellers showed their potential yesterday following the release of important U.S. data, which was not as bad as many had expected. In the case of a slight rise in EUR/USD in the first half of the day following Eurozone data, bears can target the nearest resistance at 1.1750. The formation of a false breakout there will provide an entry point for short positions, aiming to move down to support at 1.1716. A breakthrough and consolidation below this range against very weak Eurozone data, along with a retest from below, will become another suitable scenario for opening short positions targeting the area of 1.1684. The farthest goal will be the 1.1649 area, where I will take profit. In the case of an upward move in EUR/USD with the trend and a lack of active bearish action around 1.1750, where the moving averages are located in favor of the bears, buyers will have a good opportunity to continue the bullish market. In this case, it is better to postpone short positions until a larger level of 1.1776. Selling there will only occur after a failed consolidation. I plan to open short positions immediately on a rebound from 1.1801 with a target of a downward correction of 30-35 pips.

Recommended for Review:

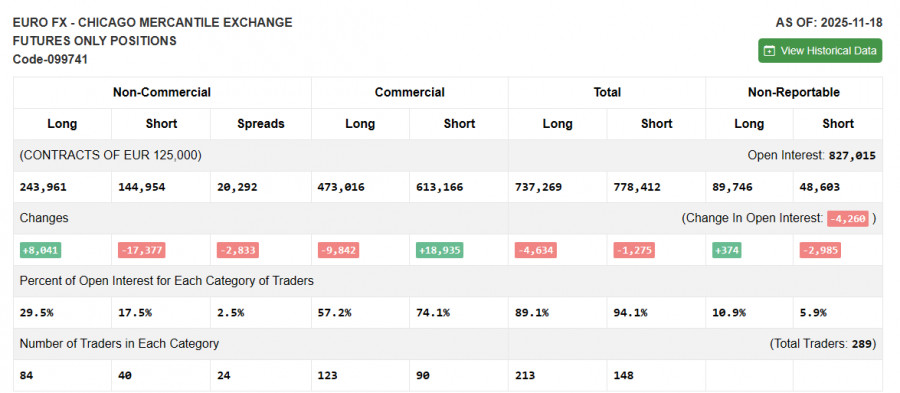

Due to the U.S. government shutdown, fresh Commitment of Traders data is not being published. As soon as the relevant report is prepared, we will publish it immediately. The latest relevant data is from November 18.

In the COT report (Commitment of Traders), there was an increase in long positions and a reduction in short positions. Expectations of further rate cuts by the Federal Reserve continue to put pressure on the U.S. dollar. The COT report indicates that long non-commercial positions increased by 8,041 to 243,961, while short non-commercial positions decreased by 17,377 to 144,954. As a result, the spread between long and short positions decreased by 2,833.

Indicator Signals:

Moving Averages: Trading is below the 30 and 50-day moving averages, indicating a decline in the euro.

Note: The periods and prices of the moving averages are considered by the author on the hourly chart H1 and differ from the standard definition of classical daily moving averages on the daily chart D1.

Bollinger Bands: In the event of a decline, the indicator's lower boundary around 1.1725 will act as support.

Description of Indicators

- Moving Average (indicates the current trend by smoothing volatility and noise). Period – 50. Marked in yellow on the chart.

- Moving Average (indicates the current trend by smoothing volatility and noise). Period – 30. Marked in green on the chart.

- MACD Indicator (Moving Average Convergence/Divergence). Fast EMA – period 12. Slow EMA – period 26. SMA – period 9.

- Bollinger Bands. Period – 20.

- Non-commercial traders are speculators, such as individual traders, hedge funds, and large institutions, using the futures market for speculative purposes and meeting certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- The total non-commercial net position is the difference between the short and long positions of non-commercial traders.