Yesterday, only one entry point into the market was formed. Let's take a look at the 5-minute chart and analyze what happened. In my morning forecast, I highlighted the level of 1.1748 and planned to make market entry decisions based on it. The rise occurred, but it did not reach the test of 1.1748, so I missed trading opportunities. In the afternoon, a false breakout in the area of 1.1748 allowed for long positions, resulting in a 20-pip increase in the pair.

To Open Long Positions on EURUSD:

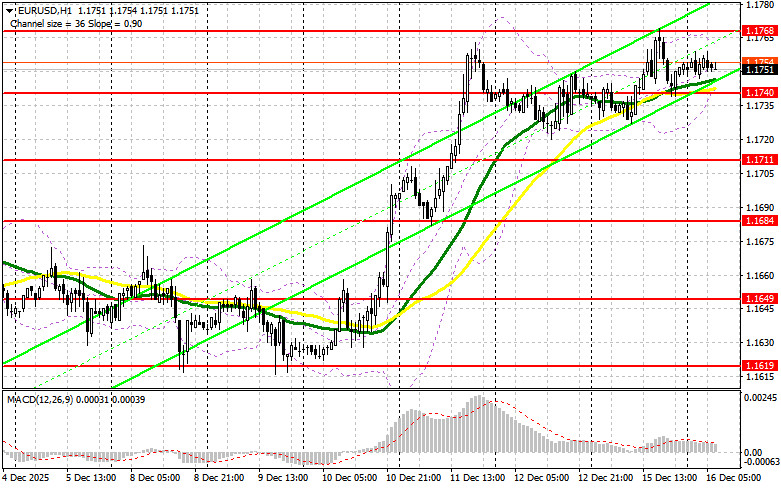

Yesterday, the euro continued to rise against the dollar after statements from Federal Reserve representative Christopher Waller, who indicated that the central bank is on the right path to stimulate the economy and reduce rates. Weak US data also put pressure on the dollar. Today, a significant amount of important data from the Eurozone is expected. It will begin with data on the services sector business activity index, the manufacturing PMI, and the composite PMI, and conclude with the ZEW economic sentiment indices for the Eurozone and Germany. With poor data and a bearish reaction, I expect to see the first signs of buyers around the 1.1740 support level. Only after a false breakout forms can we obtain an entry point for long positions, aiming for a recovery to around 1.1768, which could not be broken above yesterday. A breakout and a retest of this range will confirm the correct buying actions on the euro, anticipating a larger surge to 1.1793. The furthest target will be the high at 1.1817, where I will take profits. Testing this level will strengthen the bullish market for the euro. In the event of a decline in EUR/USD and a lack of activity around 1.1740, pressure on the pair will increase�especially before important US data�and bears will aim to reach the next interesting level at 1.1711. Only if there is a false breakout will there be a suitable condition to buy the euro. Long positions will open immediately at a rebound from 1.1684, targeting an upward correction of 30-35 pips intraday.

To Open Short Positions on EURUSD:

Sellers showed up only after yesterday's update of the weekly high. But today, they will have their chance. This opportunity could come from weak Eurozone PMI data or strong US labor market data. If further growth in EUR/USD continues the trend in the first half of the day, bears can only rely on the nearest resistance level of 1.1768. A false breakout there will give an entry point for short positions targeting the support level of 1.1740, where the moving averages align with the bulls. A breakout and settlement below this range against very weak Eurozone data, accompanied by a retest from below, will also present a suitable option for opening short positions targeting around 1.1711. The most distant target will be the area of 1.1684, where I will take profits. In the case of an upward move in EUR/USD following the trend and a lack of active bearish action around 1.1768, buyers will have a good opportunity to sustain bullish market development. In such a case, it would be best to postpone short positions until the larger level of 1.1793. Selling there will occur only after a failed attempt to stabilize. I plan to open short positions immediately on a rebound from 1.1817, targeting a downward correction of 30-35 pips.

Recommended for Review:

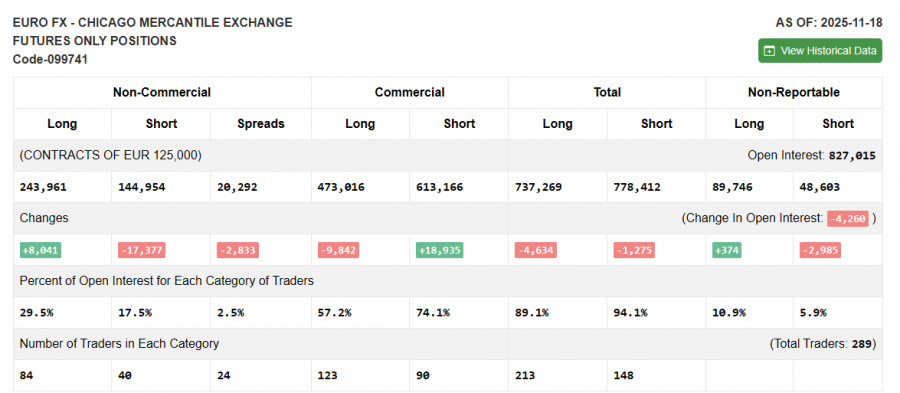

Due to the US government shutdown, fresh Commitment of Traders (COT) data is not being published. As soon as the current report is prepared, we will publish it immediately. The latest available data is only from November 18.

In the COT report (Commitment of Traders), there was an increase in long positions and a decrease in short positions. Expectations of further rate cuts by the Federal Reserve continue to exert pressure on the US dollar. The COT report indicated that non-commercial long positions increased by 8,041 to a level of 243,961, while non-commercial short positions decreased by 17,377 to a level of 144,954. As a result, the spread between long and short positions narrowed by 2,833.

Indicator Signals:

- Moving Averages: Trading occurs above the 30-day and 50-day moving averages, indicating further growth for the euro.

- (Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the standard definition of classical daily moving averages on the daily chart D1.)

- Bollinger Bands: In the event of a decline, the indicator's lower boundary will act as support around 1.1740.

Description of Indicators:

- Moving Average (period 50): Indicates the current trend by smoothing volatility and noise, highlighted in yellow on the chart.

- Moving Average (period 30): Indicates the current trend by smoothing volatility and noise, highlighted in green on the chart.

- MACD (Moving Average Convergence/Divergence): Fast EMA - period 12. Slow EMA - period 26. SMA - period 9.

- Bollinger Bands (Period - 20).

- Non-commercial traders: Speculators, such as individual traders, hedge funds, and large institutions, using the futures market for speculative purposes and meeting specific requirements.

- Long non-commercial positions: Represents the total long open position of non-commercial traders.

- Short non-commercial positions: Represents the total short open position of non-commercial traders.

- Total non-commercial net position: The difference between short and long positions among non-commercial traders.