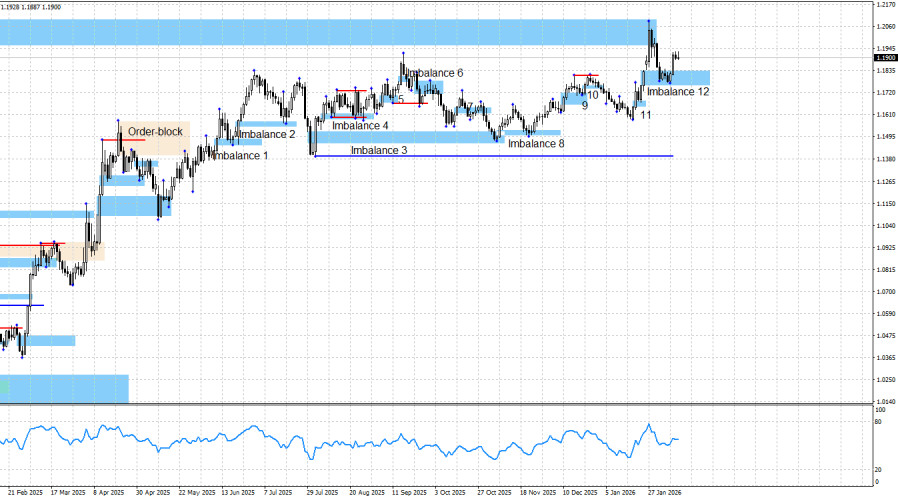

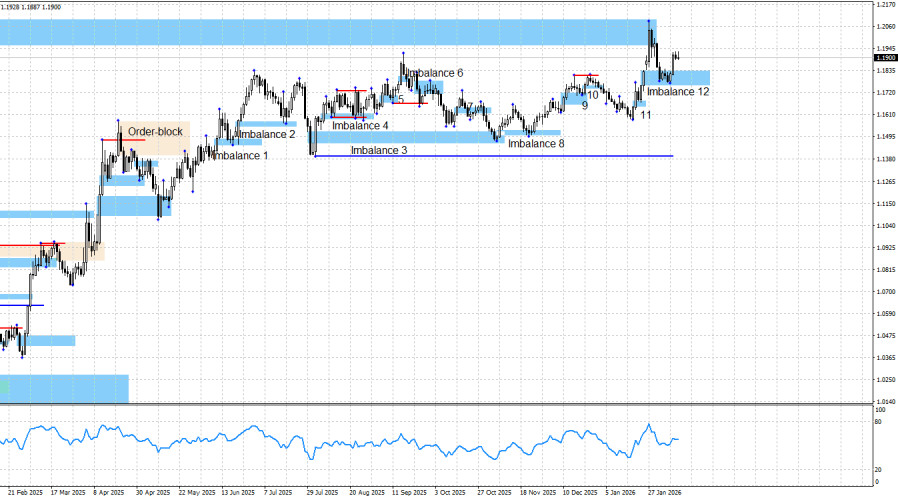

The EUR/USD pair rebounded from bullish imbalance 12 and reversed in favor of the European currency, as I had warned. Thus, traders received yet another bullish signal, allowing them to open long positions in the market. However, today the situation for the bulls is no longer as favorable as it has been in recent days. A few hours ago, U.S. labor market and unemployment data were released. Eight out of ten traders were expecting, at best, neutral figures close to forecasts. However, the labor market delivered a surprise that no one expected. The number of new jobs in January totaled 130,000 compared to market expectations of around 70,000, while the unemployment rate declined from 4.4% to 4.3%, which no one had anticipated. As a result, the bears unexpectedly gained strong support for launching their own attack.

At the moment, too little time has passed since the U.S. reports were released to determine how much the dollar will strengthen and, accordingly, how far EUR/USD will decline. Yesterday I warned that situations occur when the news background does not align with the technical picture. A conflict arises in which only one side can prevail. Therefore, it is now important to understand whether the bulls will retain the initiative. Imbalance 12 will continue to serve as a support zone, and its invalidation would signal the start of a bearish offensive.

For now, the technical picture continues to signal bullish dominance. The bullish trend remains intact. A bullish signal was formed in imbalance 11, and later another bullish signal appeared in imbalance 12. Thus, traders may keep long positions open. Today or tomorrow, imbalance 12 could be invalidated, which would temporarily halt the bullish advance, but I would not rush to conclusions.

As expected, Wednesday's news background made an impact on the market. However, it is not the reports themselves that move prices, but traders. What matters now is whether the dollar's rise will be strong and sustained, or whether the market's reaction to the strong Nonfarm Payrolls and unemployment data will prove short-lived.

Bulls have had sufficient reasons for a renewed advance for the past six to seven months, and with each week those reasons only increase. These include the dovish (in any case) outlook for FOMC monetary policy, Donald Trump's overall policy (which has not changed recently), the U.S.–China confrontation (where only a temporary truce has been reached), public protests in the United States against Trump under the slogan "No kings," labor market weakness, the autumn "shutdown" (which lasted a month and a half), and a new "shutdown" at the beginning of February. There is also U.S. military aggression toward certain states, criminal proceedings against Powell, the "Greenland confusion," and worsening relations with Canada and South Korea. In my view, further growth of the pair would therefore be entirely logical.

I still do not believe in a bearish trend. The news background remains extremely difficult to interpret in favor of the dollar, which is why I do not attempt to do so. The blue line shows the price level below which the bullish trend can be considered over. Bears would need to push the price down about 460 points to reach it, and I consider this task unrealistic given the current news background and technical picture, where not a single bearish pattern has formed. The nearest upward target for the euro had been the bearish imbalance at 1.1976–1.2092 on the weekly chart, formed back in June 2021. This pattern has now been fully filled. Above that, two levels can be identified — 1.2348 and 1.2564 — which correspond to two peaks on the monthly chart.

News Calendar for the U.S. and the Eurozone:

- U.S. – Initial Jobless Claims (13:30 UTC).

- U.S. – Existing Home Sales (13:30 UTC).

On February 12, the economic calendar contains two entries, neither of which I consider important. The impact of the news background on market sentiment on Thursday may be weak.

EUR/USD Forecast and Trading Advice:

In my view, the pair remains in the process of forming a bullish trend. Despite the news background favoring the bulls, bears have repeatedly launched attacks in recent months. However, I see no realistic reasons for the start of a sustained bearish trend.

From imbalances 1, 2, 4, 5, 3, 8, and 9, traders had opportunities to buy the euro. In each case, we saw certain growth, and the bullish trend has persisted. Last week, a new bullish signal formed at imbalance 11, again allowing traders to open long positions targeting 1.1976. That target was reached. This week, another bullish signal formed at imbalance 12, providing traders with a new opportunity to buy the pair. The formal targets are 1.2348 and 1.2564.