The GBP/USD currency pair continued to trade in a total flat on April 2. What caused the dollar to stop falling? After all, Trump announces new tariffs or teases upcoming ones almost every week. First, we want to emphasize that such an important event as the announcement of a new U.S. trade policy shouldn't be analyzed hastily. Recall that it's not uncommon for EUR/USD to move strongly in one direction right after a Federal Reserve meeting, only to retrace the next day. The same could happen here, as these are events of similar scale. It's best to conclude only after some time has passed.

Let's also recall that just a week ago, Trump imposed tariffs on all automobile imports into the U.S., and the dollar didn't significantly decline. Why? In our view, the market is simply tired of Donald Trump. Yes, tired—after less than 2.5 months of his presidency. It brings to mind the first four years of Trump in office: two impeachment attempts, hostile remarks toward journalists, a trade war with China, and an average of 14.6 false statements per day (official data). So, if anyone truly believed Trump would end the Ukraine conflict in 24 hours, they were likely very naive.

Likewise, Trump promises to "Make America Great Again" but fails to mention who will pay for his plans. It might seem like the rest of the world, who've "robbed America for years." However, the Trump administration is slapping an additional 10–25% cost on any imported goods. And who pays for these goods? American companies and consumers. So, who's footing the bill for America's future greatness? Americans themselves.

Demand for European and Chinese goods will fall, and the EU and China will suffer from the tariffs. But they will suffer—Americans will pay. Trump wants to lower taxes and introduce various tax breaks, but it all looks like: "We'll raise prices by 25%, then give a 5% discount." In any case, the American people elected Trump, and at this point, there's no use crying over spilled milk. They knowingly chose a leader with a well-documented governing style—they had four years to observe it. That choice signals that they accept the consequences. Previously, many Americans criticized high spending under Democrats on aid to Ukraine, Israel, and NATO. With Trump, Washington will spend less, and Americans will pay more for the same goods they used to buy.

The British pound maintains a short-term uptrend while the long-term downtrend persists. We don't see strong reasons for a sustained rally in the British currency.

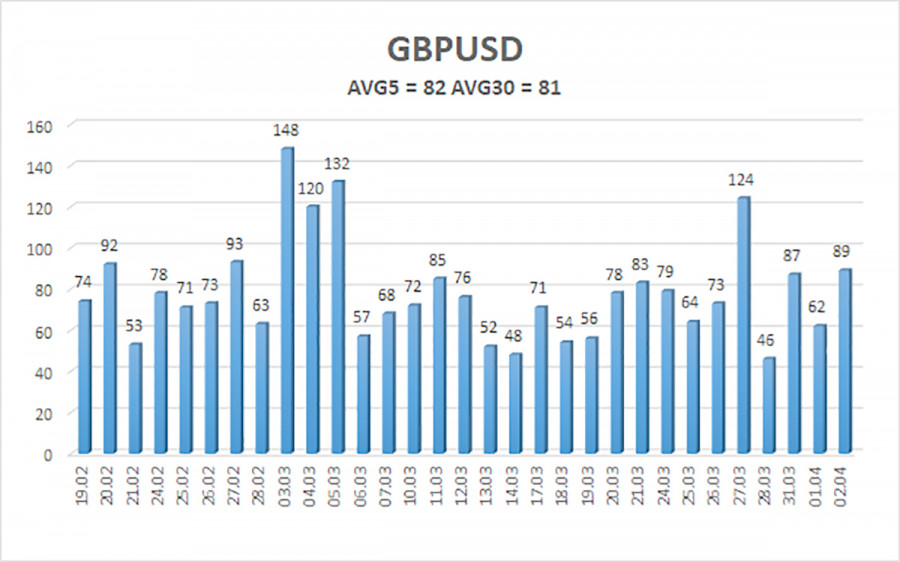

The average volatility of the GBP/USD pair over the last five trading days is 82 pips, which is considered "average" for this currency pair. On Thursday, April 3, we expect the pair to trade within a range limited by 1.2881 to 1.3045. The long-term regression channel has turned upward, but the downtrend remains intact on the daily timeframe. The CCI indicator has not recently entered overbought or oversold territory.

Nearest Support Levels:

S1 – 1.2939

S2 – 1.2817

S3 – 1.2695

Nearest Resistance Levels:

R1 – 1.3062

R2 – 1.3184

R3 – 1.3306

Trading Recommendations:

GBP/USD maintains a medium-term downtrend, while the 4-hour chart shows a weak correction that could end as the market avoids buying the dollar. We still do not consider long positions, as the current upward move appears to be a technical correction on the daily timeframe that has become illogical. However, if you trade based purely on technicals, long positions are possible with targets at 1.3045 and 1.3062—but the market is still range-bound. Short positions remain more attractive, with targets at 1.2207 and 1.2146, because sooner or later, the upward correction on the daily chart will end (assuming the previous downtrend hasn't ended already). The British pound looks extremely overbought and unjustifiably expensive, but it's hard to predict how long the dollar's Trump-driven decline will last.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.