Analysis of Tuesday's Trades

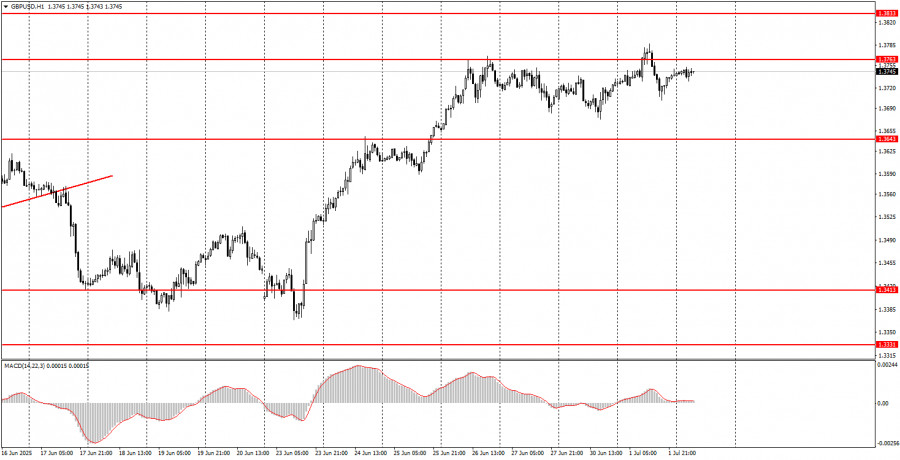

1H Chart of GBP/USD

On Tuesday, the GBP/USD pair also showed signs of continuing its upward movement. Only during the U.S. trading session did the dollar somehow manage to strengthen slightly, but this should not be taken as a sign that the dollar's struggles are over. The market merely underwent a slight correction on the back of somewhat positive reports from across the Atlantic, but by the end of the day, it returned to Tuesday's opening levels. Yes, the dollar gained some ground and the market reacted to U.S. data, but what impact did that have on a broader scale? Already today, the U.S. currency may resume its decline, as there are still plenty of factors pushing the market to sell dollars. Ahead lie the unemployment and Nonfarm Payrolls reports. If these indicators deteriorate, it will bring the Federal Reserve closer to resuming monetary easing. And the U.S. dollar is already falling even without rate cuts. If they resume, the dollar's decline will only accelerate.

5M Chart of GBP/USD

On the 5-minute timeframe on Tuesday, two trading signals were also generated. First, the pair broke above the 1.3763 level, then fell back below it. The first signal turned out to be 100% false, while the second allowed novice traders to earn around 25 pips, which at least helped offset the loss from the first trade.

Trading Strategy for Wednesday:

On the hourly chart, the GBP/USD pair continues to look solely in Donald Trump's direction and remains highly skeptical of his policies. The market continues to either sell the dollar or wait for fresh negative news from overseas to resume selling. This will persist until the market sees real signs of the trade war ending, and until Trump stops making decisions he has no authority to make—decisions that leave market participants aghast.

On Wednesday, the GBP/USD pair may continue its upward movement, as the market has entered a new phase of the uptrend. As before, there are plenty of fundamental reasons for the market to steer clear of the U.S. currency.

On the 5-minute chart, you can currently trade around the following levels: 1.3203–1.3211, 1.3259, 1.3329–1.3331, 1.3413–1.3421, 1.3518–1.3535, 1.3580–1.3592, 1.3643–1.3652, 1.3682, 1.3763, 1.3814–1.3832.

On Wednesday, there will be virtually no macroeconomic or fundamental events in the UK or the U.S., but it is worth noting that Trump and Musk have started a new escalation of personal conflict. Trump now wants to deport Musk, while Musk wants to create a new political party in the U.S. to rival both the Democrats and Republicans.

Core Trading System Rules:

- Signal Strength: The shorter the time it takes for a signal to form (a rebound or breakout), the stronger the signal.

- False Signals: If two or more trades near a level result in false signals, subsequent signals from that level should be ignored.

- Flat Markets: In flat conditions, pairs may generate many false signals or none at all. It's better to stop trading at the first signs of a flat market.

- Trading Hours: Open trades between the start of the European session and the middle of the US session, then manually close all trades.

- MACD Signals: On the hourly timeframe, trade MACD signals only during periods of good volatility and a clear trend confirmed by trendlines or trend channels.

- Close Levels: If two levels are too close (5–20 pips apart), treat them as a support or resistance zone.

- Stop Loss: Set a Stop Loss to breakeven after the price moves 20 pips in the desired direction.

Key Chart Elements:

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.