EUR/USD 5-Minute Analysis

On Wednesday, the EUR/USD currency pair declined slightly but generally showed no inclination to follow the British pound, which had crashed by nearly 200 points. The euro remained above the critical Kijun-sen line and the 1.1750 level, making a further upward correction highly questionable. As we can see, the market still has no desire to buy the dollar. As for why the pound plunged like a stone, we will examine that in the GBP/USD article.

Yesterday was the least eventful day of the past two weeks. Recall that last week featured several significant events of various kinds, and even this week has already seen the release of several fairly important reports. Of course, not all reports posted standout figures worthy of a market response. Most of the dollar-supportive reports were ignored, such as the ISM Manufacturing PMI and the JOLTs report on Tuesday. Thus, market sentiment toward the euro remains completely unchanged.

On Wednesday, the U.S. published the ADP report, which is considered a "little brother" to the Non-Farm Payrolls. A weak ADP report does not necessarily mean that the Non-Farm payroll report will also disappoint. Still, we see no reason why the market should suddenly start buying dollars or dumping the euro. It should be understood that what happened yesterday to the British pound was either a random event or a deliberate move by market makers.

On the 5-minute timeframe, two identical trading signals formed during the day. During the U.S. session, the price rebounded twice from the 1.1750 level along with the Kijun-sen line. On the second attempt, the pair moved up about 30 points, and the long trade could have been closed manually or held for more profit by moving the Stop Loss to breakeven.

COT Report

The latest COT report is dated June 24. As clearly shown in the illustration above, the net position of non-commercial traders had been "bullish" for a long time. Bears barely gained the upper hand by the end of 2024 but quickly lost that advantage. Since Trump assumed the presidency, only the dollar has been falling. We cannot say with 100% certainty that the decline will continue, but current global developments suggest that it may very well do so.

We still see no fundamental reasons for the euro to strengthen — but there is one strong reason for the dollar to fall. The global downtrend remains in place. But at this point, does it matter where the price moved over the past 16 years? Once Trump ends his trade wars, the dollar might begin to recover — but will Trump ever end them? And when?

Currently, the red and blue lines have crossed again, which means the market trend has once again turned bullish. During the last reporting week, the number of long positions in the non-commercial group increased by 3,000 contracts, while the number of short positions decreased by 6,600. As a result, the net position increased by 9,600 contracts over the week.

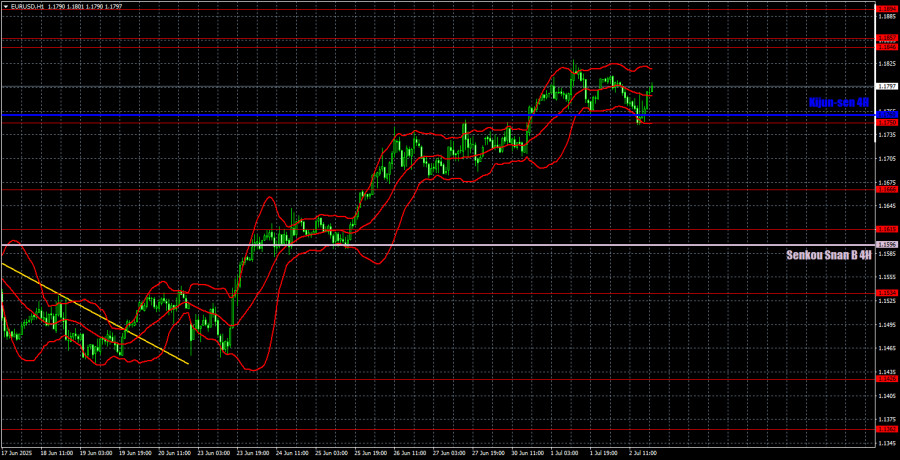

EUR/USD 1-Hour Analysis

On the hourly timeframe, the EUR/USD pair continues to form an upward trend, and the movement remains almost uncorrected—this is visible on virtually any chart above the hourly level. Information continues to pour out of the U.S., which is essentially forcing traders to sell the dollar. This includes data about the economy, politics, immigration, and social support issues. The market continues to respond clearly to these developments. Only a consolidation below the critical line would allow the dollar to regain some ground.

We highlight the following levels for trading on July 3: 1.1092, 1.1147, 1.1185, 1.1234, 1.1274, 1.1362, 1.1426, 1.1534, 1.1615, 1.1666, 1.1750, 1.1846–1.1857, as well as the Senkou Span B line (1.1596) and the Kijun-sen line (1.1760). Ichimoku indicator lines may shift during the day, which should be taken into account when determining trading signals. Don't forget to place Stop Loss orders at breakeven if the price moves 15 pips in the correct direction. This helps protect against potential losses if the signal proves to be false.

Among Thursday's important events, we highlight U.S. reports on unemployment, the labor market, and the ISM Services PMI. The first two are typically released on Fridays, but due to the U.S. Independence Day holiday on Friday, the releases were rescheduled to Thursday.

Illustration Explanations:

- Support and resistance price levels – thick red lines where movement may end. They are not trading signal sources.

- Kijun-sen and Senkou Span B lines—These are strong Ichimoku indicator lines transferred to the hourly timeframe from the 4-hour one.

- Extremum levels – thin red lines where the price has previously rebounded. These act as trading signal sources.

- Yellow lines – trend lines, trend channels, and other technical patterns.

- COT Indicator 1 on the charts – the size of the net position for each category of traders.