was formed on 02.05 at 12:00:11 (UTC+0)

signal strength 4 of 5

signal strength 4 of 5

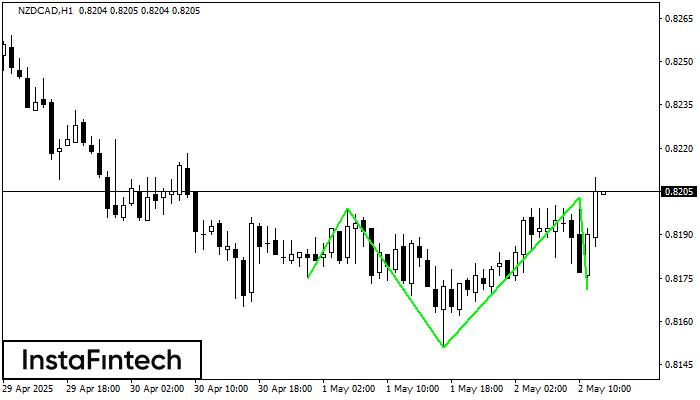

According to the chart of H1, NZDCAD produced the pattern termed the Inverse Head and Shoulder. The Head is fixed at 0.8151 while the median line of the Neck is set at 0.8199/0.8203. The formation of the Inverse Head and Shoulder Pattern clearly indicates a reversal of the downward trend. In means that in case the scenario comes true, the price of NZDCAD will go towards 0.8243.

Figure

Instrument

Timeframe

Trend

Signal Strength